Thanks to you, a “home away from home” will be standing strong to welcome the community for years to come.

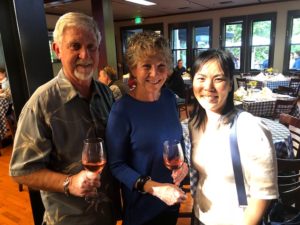

Supporter Dennis Gilardi and founder Karen Schurig celebrate as Schurig Center ‘lands’ in its permanent location in 2005

After more than a decade of normal wear and tear and rainy seasons, our building needed some T.L.C. This spring, thanks to you, the center received dry rot repair and a fresh coat of paint to help prolong its life for years to come. In the last year, an interior wall was also added to create an extra room for individual Occupational and Speech Therapy sessions.

Big thanks to… Cahill Contractors, The Bothin Foundation, Valdez Painting and the many people who donated to the building repair project.

We hope you’ll stop by soon for a visit!

Schurig Center today.